IBCO Voting Proposal

2022-04-22

TLDR: Vote to change the current Token Burn Mechanics. Use up to ½ of the liquidity of the IBCO to buy and burn tokens from the market.

Since the launch of the OVER platform, we’ve burned more than 2 million OVR Tokens. This was possible, thanks to the burning mechanism linked to OVRLand sales. This was an important accomplishment in our roadmap yet we still asked ourselves, “Is there more we can do to improve this process?” The answer is yes. By using the DAO voting system with IBCO-enabled burning, we can now substitute the current OVRLand sales-related burning mechanism.

The IBCO has been the object of a lot of attention from the OVER community; it is loved when there is the pressure to sell and hated when the price pumps. In fact, the IBCO behaves like a sponge, absorbing liquidity when the price grows and releasing it when the price goes down. These actions smooth out price fluctuations making the OVR Token less volatile compared with tokens that are less liquid and with similar market caps. The liquidity absorbed by the IBCO is the key to the increased token burn. We’re now proposing a vote to change the IBCO parameters, but before diving into the proposal and its implications, let’s recap how the IBCO works.

“The liquidity absorbed by the IBCO is the key to the increased token burn.”

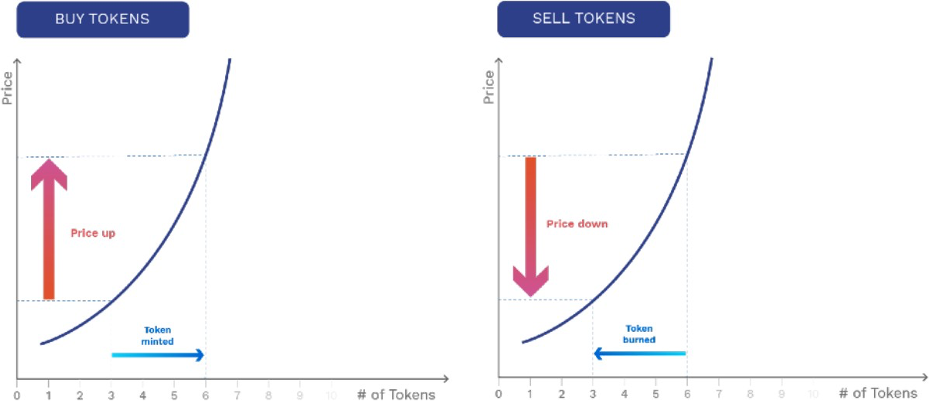

The IBCO creates a variable supply for OVR Tokens by minting tokens when the price grows (when people buy OVR with DAI on the IBCO) and burning those when the price goes down (by acquiring tokens from the market with DAI reserves).

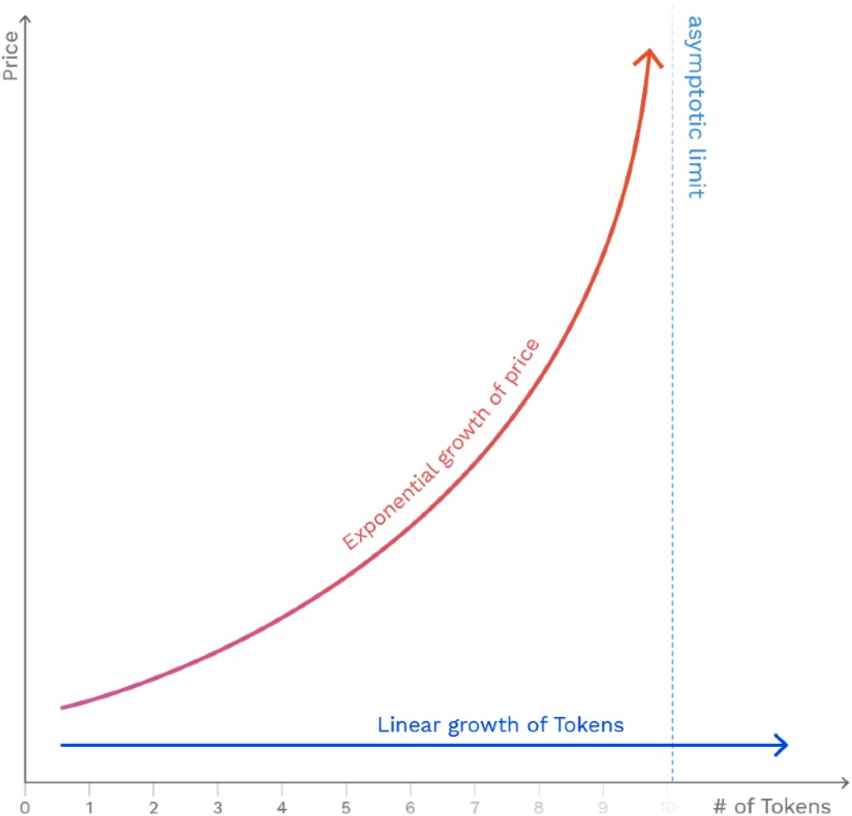

The total amount of tokens minted by the IBCO decreases exponentially at each price level; indeed, while the amount of tokens minted grows linearly, the cost of each new token grows exponentially. Such a dynamic allows for a market-driven supply cap (when the price is too high, nobody will buy more tokens).

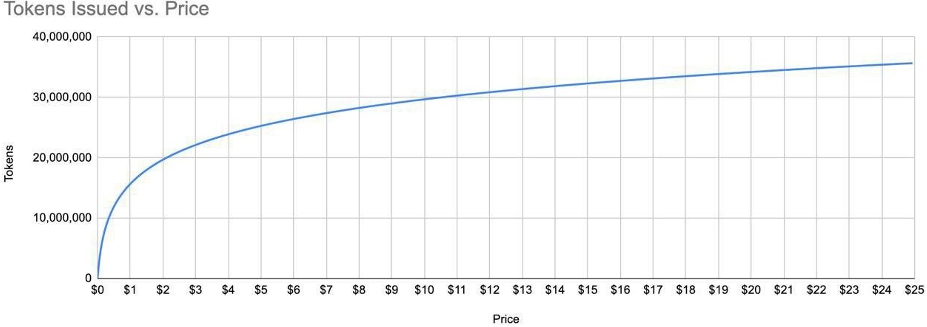

But what is the cumulative sum of tokens created by the IBCO at each price level in the current configuration, you may ask? The chart below illustrates how the emission rate decreases exponentially with the price increase.

We will now explain how the voting proposal permanently impacts the number of tokens at each price level.

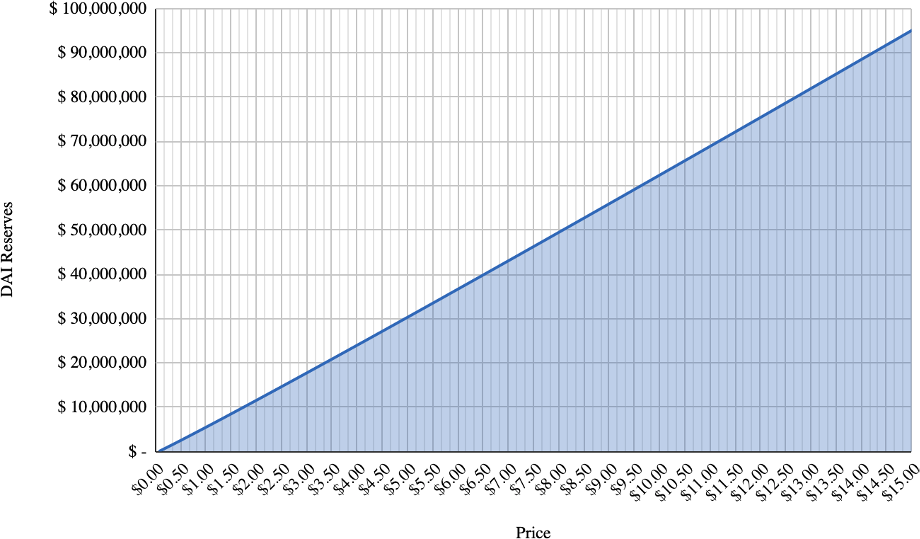

The IBCO smooths out price fluctuations by absorbing and locking up liquidity (DAI) in its bonding curve. Such a reserve grants collateral liquidity (DAI) for the token. Below is a chart representing the amount of liquidity absorbed by the IBCO at each price level in the current configuration.

But what about the interaction between the IBCO and other markets?

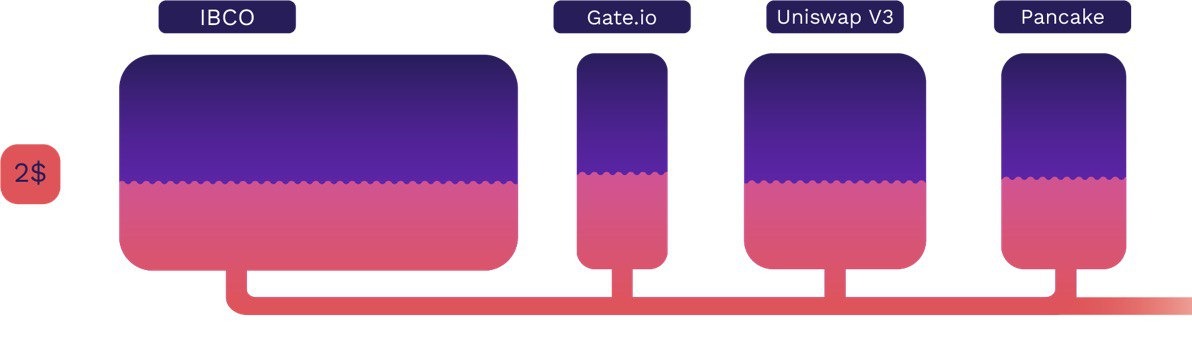

We can explain the interactions between the different OVR Token markets using communicating vessels as an analogy; price sensitivity in any of these vessels is defined by the amount of liquidity (collateral) in each market, specifically book dept for CEXs and liquidity pool dimension for DEXs.

Since one liter of water in different vessels results in different liquid levels based on the dimension of the vessel, the final execution price (initial price + slippage) for a defined amount of investment in each market will be influenced by the liquidity present in a particular market. Price differences can arise between markets because of the difference in liquidity pool dimensions and activity. Yet, the arbitrage between those will level the prices, just like the level of fluids in communicating vessels.

Technically the voting proposal consists of changing the parameter of the IBCO that controls the static price of the IBCO, and such a parameter is called Collateral Weight (CW). Any change to such a parameter is inversely proportional to the new static price level. Details and formulas on the IBCO functioning can be found on the Bancor formula White Paper.

The IBCO parameter change proposal is the following:

Change the CW to ½ of the current value.

The immediate effect will be the following:

1) Double the static price of the IBCO;

2) Double the volatility of the IBCO, halving the liquidity reserves for any price level on the IBCO;

3) Halving the number of tokens issued by the IBCO at any price level;

The secondary effects will be the following:

1) The IBCO will buy and burn OVR Tokens from other markets deploying up to ½ of its DAI reserves;

2) Depending on the proportion between the liquidity in the IBCO and the one in other markets, the price will find a new higher equilibrium. The new equilibrium does not consider the possible price effects (positive or negative) related to the market’s anticipation of the result of the vote.

To better understand the effect on the token price described in point 2) let’s come back to the communicating vessels analogy.

T0 – The system’s state before the change of the CW with a hypothetical price of 2$.

T1 – The system’s state at the instant of the CW halving.

T2 – The new price equilibrium generated by the liquidity transfer (DAI) from the IBCO to the other markets. In other words, the IBCO buys and burns tokens from other markets.

Note that while the halving of the IBCO vessel from T0 and T1 is at scale, the dimension of other vessels is only illustrative. The amount of tokens that the IBCO will buy back and burn, depends on the proportion of liquidity present in the IBCO, compared to all the other markets.

A DAO will control the IBCO under the Aragon framework. To perform such a change, voting from token holders is necessary; tokens locked in vesting smart contracts or staking are not usable for voting. The voting proposal will require the authorization to decrease the CW to ½ of its current value during a timespan of 3 months to avoid price speculation.

In the coming days, we will release a voting quorum, a qualified majority, and a guide on how to perform voting.